Managing Your Finances Efficiently with Notion in Just 15 Minutes a Month

Managing finances can often feel overwhelming, but with the right tools and approach, it doesn't have to take more than 15 minutes a month. In this blog post, I'll share how I track my finances using Notion, a versatile tool that helps keep everything in one place. While I'm not a financial expert, I've learned a lot over the past six years about efficiently tracking finances, and I'm excited to show you how to make this process simple and effective.

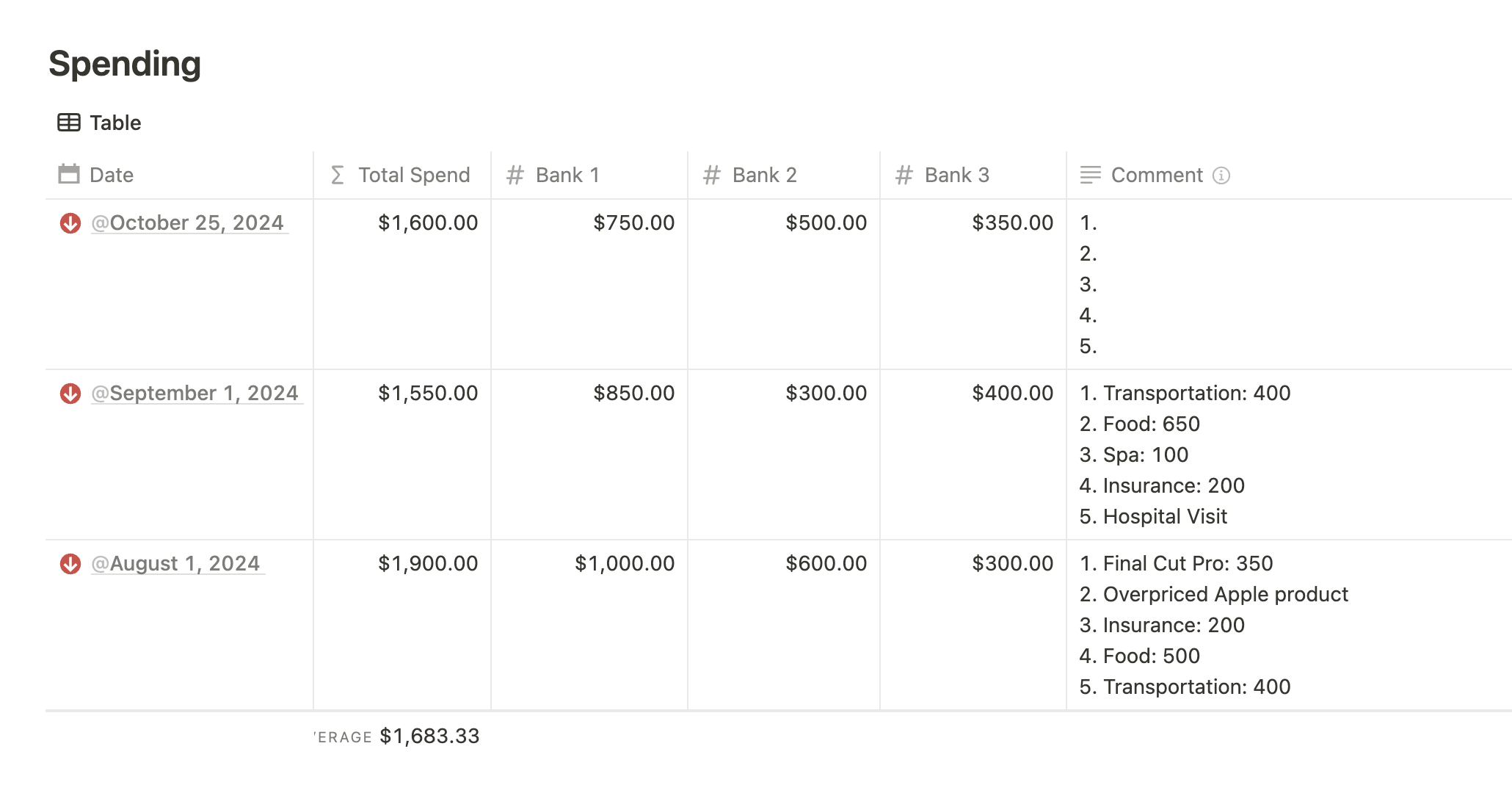

1. Simplifying Your Spending

Let's simplify how you track your spending. I use Notion to create a straightforward page listing all my expenses. By categorizing my spending and highlighting the most significant costs each month, I can easily see where my money goes. For instance, if a large portion of my expenses are on Apple products or subscriptions like Final Cut Pro, I can document these amounts.

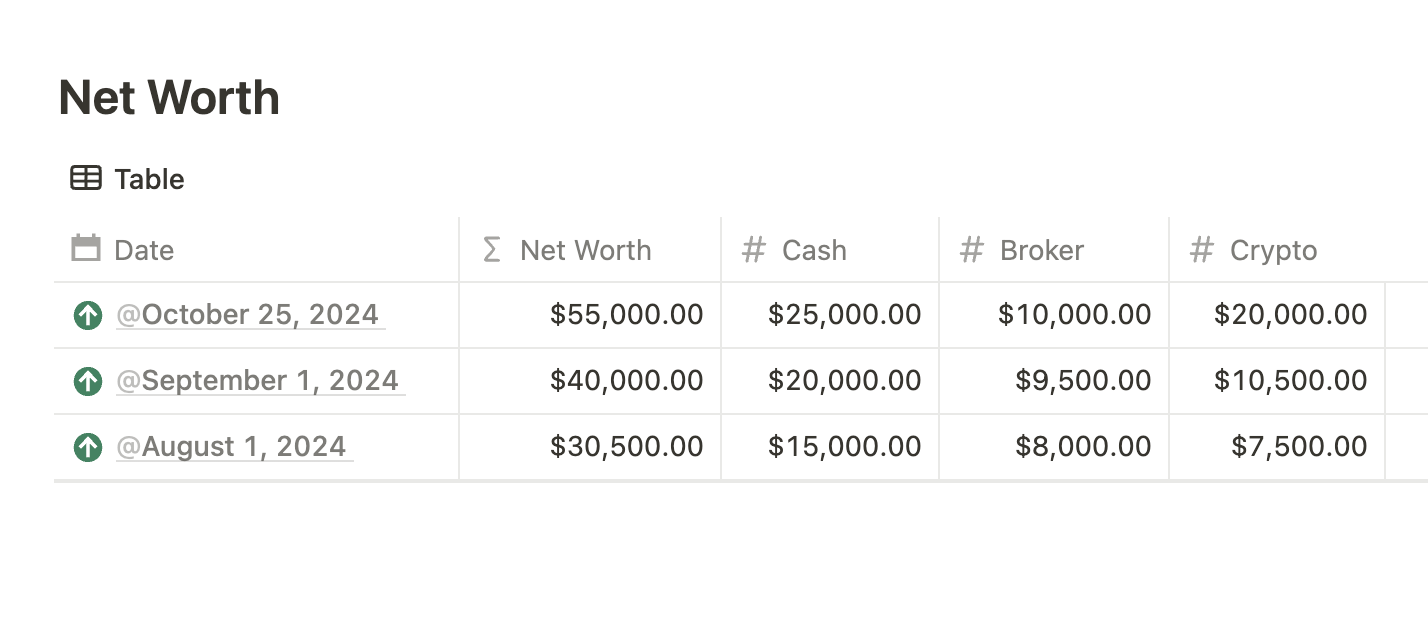

2. Monitoring Your Net Worth

Tracking your net worth can be eye-opening. By logging your cash, stocks, and cryptocurrencies in Notion, you'll see your financial trajectory—whether it's rising or falling. The process is simple: record your assets at each month's end and watch the changes over time. You can customize the template to include more accounts or assets and even use different currencies if needed. This creates a comprehensive snapshot of your financial health.

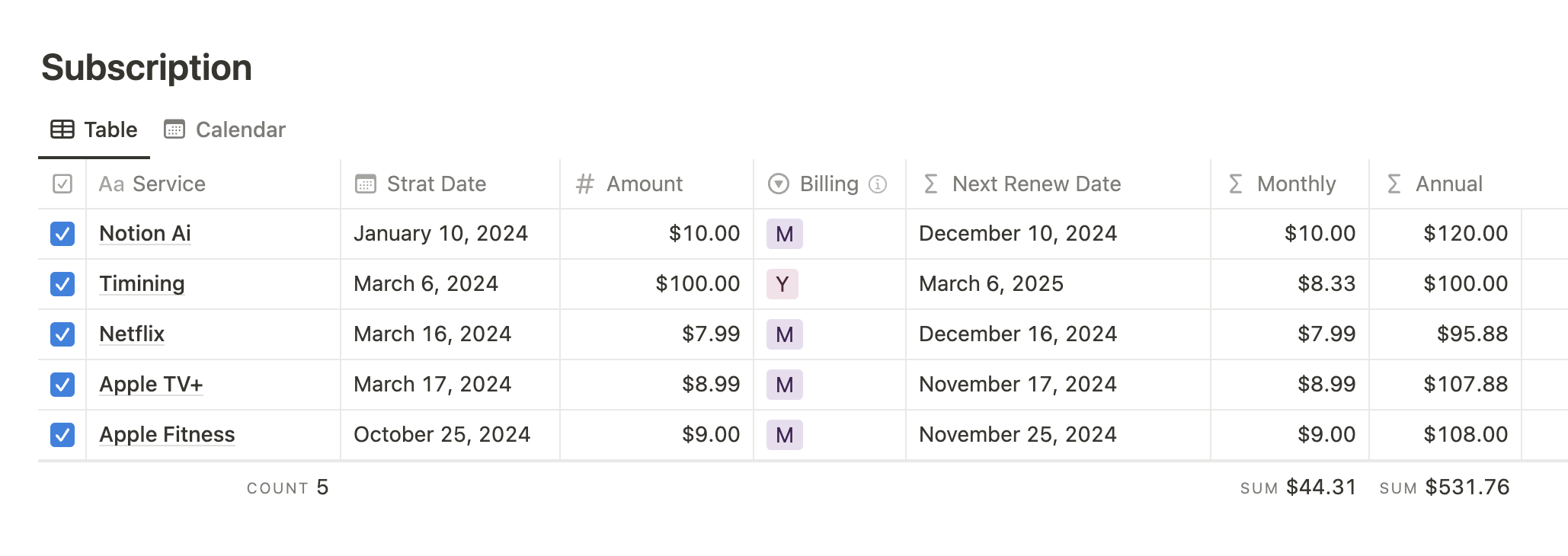

3. Staying on Top of Subscriptions

Subscriptions can quickly add up, but Notion's calendar view helps you track renewal dates and avoid unexpected charges. Simply enter your subscription details—such as cost and renewal frequency—and Notion calculates your monthly or yearly spending. This streamlines budget management and planning. For an in-depth explanation of this system, you can watch my How to Use Notion Calendar (For Beginners) video.

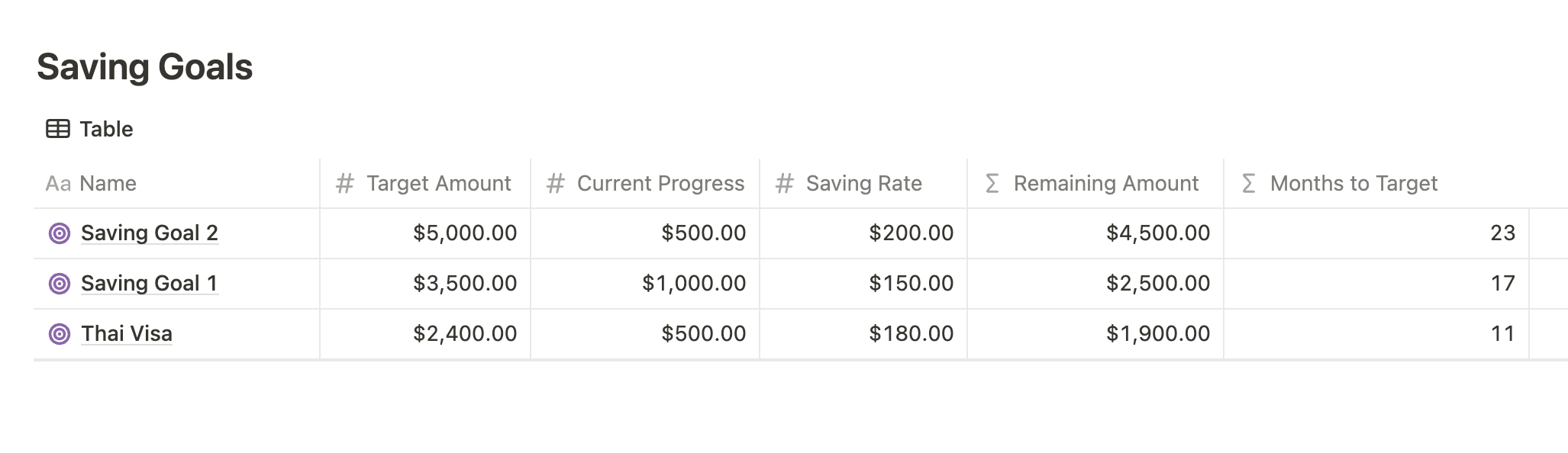

4. Achieving Saving Goals

When it comes to saving goals, I check my progress every three months. For example, if I need to save for a visa renewal, I set a target amount and timeline, then monitor how much I need to save monthly to meet that goal. This feature allows you to play around with different amounts and timelines, helping you to fine-tune your savings plan.

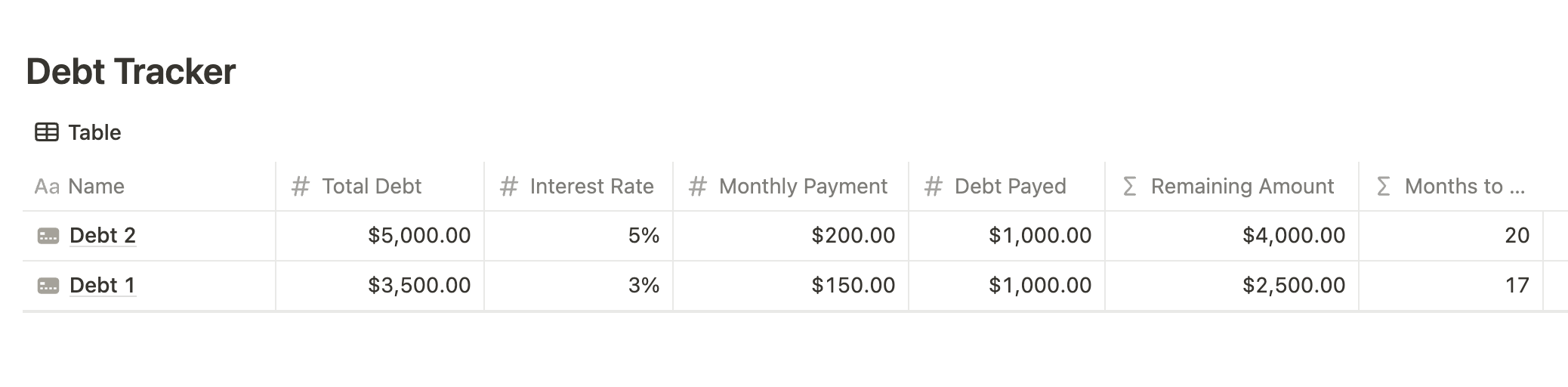

5. Managing Debts Effectively

Finally, handling debts can be daunting, but Notion's debt tracker simplifies the process. By documenting your debts, interest rates, and monthly payments, you can accurately calculate the time it will take to pay them off. Whether it's a student loan or a mortgage, sorting by debt amount or interest rate helps prioritize payments.

Conclusion

In just 15 minutes a month, you can have a clear overview of your finances. This streamlined process allows me to focus on the big picture rather than every single detail, ensuring that my financial management is efficient and stress-free. If you find this approach helpful, check out more videos for a deeper dive into these tools and techniques. Thank you for reading, and I hope this inspires you to take control of your financial future in a similar fashion. Have a great day, and stay tuned for more insights!